Parents and grandparents use 529 education savings plans to help with the cost of college expenses. However, 529 plans are a helpful strategy for estate planning, according to a recent article, “Reap The Recently-Created Planning Advantages Of 529 Plans” from Forbes.

There’s no federal income tax deduction for contributions to a 529 account. However, 35 states provide a state income tax benefit—a credit or deduction—for contributions, as long as the account is in the state’s plan. Six of those 35 states provide income tax benefits for contributions to any 529 plan, regardless of the state it’s based in.

Contributions also receive federal estate and gift tax benefits. A contribution qualifies for the annual gift tax exclusion, which is $16,000 per beneficiary for gifts made in 2022. Making a contribution up to this amount avoids gift taxes and, even better, doesn’t reduce your lifetime estate and gift tax exemption amount.

Benefits don’t stop there. If it works with the rest of your estate and tax planning, in one year, you can use up to five years’ worth of annual gift tax exclusions with 529 contributions. You may contribute up to $80,000 per beneficiary without triggering gift taxes or reducing your lifetime exemption.

You can, of course, make smaller amounts without incurring gift taxes. However, if this size gift works with your estate plan, you can choose to use the annual exclusion for a grandchild for the next five years. Making this move can remove a significant amount from your estate for federal estate tax purposes.

While the money is out of your estate, you still maintain some control over it. You choose among the investment options offered by the 529 plan. You also have the ability to change the beneficiary of the account to another family member or even to yourself, if it will be used for qualified educational purposes.

The money can be withdrawn from a 529 account if it is needed or if it becomes clear the beneficiary won’t use it for educational purposes. The accumulated income and gains will be taxed and subject to a 10% penalty but the original contribution is not taxed or penalized. It may be better to change the beneficiary if another family member is more likely to need it.

As long as they remain in the account, investment income and gains earned compound tax free. Distributions are also tax free, as long as they are used to pay for qualified education expenses.

In recent years, the definition of qualified educational expenses has changed. When these accounts were first created, many did not permit money to be spent on computers and internet fees. Today, they can be used for computers, room, and board, required books and supplies, tuition and most fees.

The most recent expansion is that 529 accounts can be used to pay for a certain amount of student debt. However, if it is used to pay interest on a loan, the interest is not tax deductible.

Finally, a 2021 law made it possible for a grandparent to set up a 529 account for a grandchild and distributions from the 529 account are not counted as income to the grandchild. This is important when students are applying for financial aid; before this law changed, the funds in the 529 accounts would reduce the student’s likelihood of getting financial aid.

Two factors to consider: which state’s 529 is most advantageous to you and how it can be used as part of a strategy for your estate planning. If you would like to learn more about 529 plans, please visit our previous posts.

Reference: Forbes (Oct. 27, 2022) “Reap The Recently-Created Planning Advantages Of 529 Plans”

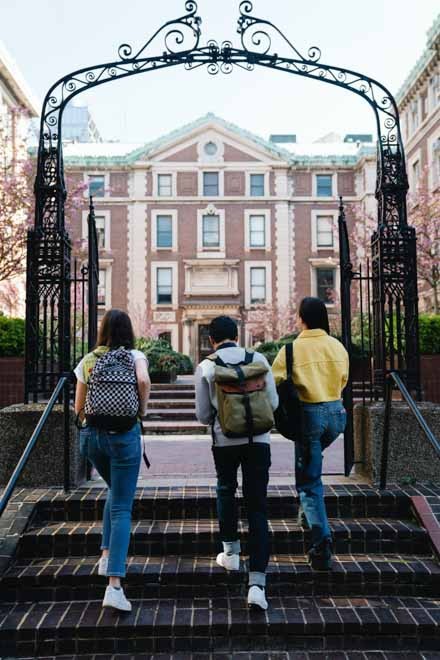

Photo by George Pak